CoinbasePro(coinbasepro提现多久到账)

文 | 学士吟

来源 | 外汇头条,ID:waihuitoutiao

编辑 | 扑克投资家,转载请注明出处

引言:狂飙突进的比特币吸引了全球投资者的目光,但真正搞懂比特币的人却寥寥无几。雅虎金融近期以“你最关心的比特币相关问题”为题,向全球资深投资者展开问卷调查,共获得近3500份回复。雅虎金融更请来全球知名的区域链专家和金融投资者作答。

这到底是什么?

从一般意义上讲,比特币是一种软件,可以形成一个没有像美联储和美国财政部这样的中央权威的集中式的点对点支付系统。把它称为数字货币或加密货币是公平的,但目前大多数投资者并没有真正用它作为货币来支付货款。相反,他们把这个作为一个投机性的投资来购买,希望转亏为盈。也许是一个很大的利润。 (也许是一个巨大的损失)。

什么支撑或支持它?

比特币运行在被称为区块链的东西上,这个软件系统通常被描述为一个不可改变的数字“分类账”。它存在于全世界数以千计的计算机上,由普通人和更复杂的计算机专家组成, 。雅虎财经的贾里德·布里克作为一名比特币矿工,在笔记本电脑的背景下运行采矿软件。以下是他迄今为止生成的比特币数量:0.000000071589。以目前的速度,他将花费大约1200年的时间来挖掘一个完整的比特币。这让你了解比特币的复杂程度,以及它需要多少处理能力:

这些电脑化的采矿机器甩掉了太多能量,可以加热你的房屋。

所有的比特币交易都是由矿工永久记录的,他们将所有这些计算机上维护的交易或“块”上传到链上。区块链技术已经在银行和其他大型金融机构中受到欢迎,他们希望用它来支付后端系统的支付。但是他们主要对没有比特币的区块链感兴趣。

谁在主演?

比特币是分散的,这意味着没有一个仲裁者,中央党派或者主管机构。交易块通过计算“共识”在区块链网络上被验证,这是软件的一个特征。比特币是2009年由某人用别名Satoshi Nakamoto创造出来的,但是现在还不知道是谁,而且这个人或者小组今天还不能控制比特币。

什么是值得的?

比特币的价格就像股票一样随着买入和卖出而波动,但是关于价格代表的是什么。理论上,比特币的价值应该反映投资者对比特币作为技术的信心。但事实上,由于供应有限,投资者往往将比特币视为商品。根据Satoshi的蓝图,比特币总供应量最终将被限制在2100万个硬币。目前,已经创建了1670万比特币。每当矿工每次将区块上传到区块链中时都会创建一小部分新币,这是对采矿的回报。

这是一个骗局吗?

从某种营销伪造产品的角度来看,这不是一个骗局。比特币是一种合法的技术。问题是它将变得多么有用和有价值。

是否真的有一个称为比特币的硬币?

不可以。因为它本质上是软件,所以不能碰到比特币。你可能已经看过金币上的“?”图像了。那些纪念品不能转换成实际的比特币。但是,他们更好地展示新闻故事,而不是像实际的区块链一样的数字流。

是否像黄金一样有形?

比特币与黄金有着相似之处,因为一些投资者认为它是金融财富价值的一个很好的存储。你可以通过下载一串数字代码来代替你的比特币 - 就像一些人拿下黄金一样 - 把代表你的财产的一串数字代码下载到一个看起来像闪存驱动器的小玩意儿上。但是,你不能像用一堆金币一样用手指摸你的比特币,而比特币肯定不会令人愉快地闪亮。

价值是否完全由自由市场决定?

多半是对的。比特币有一个已知和有限的供应,所以当需求上涨时,价格也是如此。技术创新也有助于比特币的价值。在2009年首次创建时,这是一件新奇的事情,市场已经确定这是一个值得一提的发明。

物质世界中不存在的东西如何具有货币价值?

区块链实际上存在于物质世界中,就像在物质世界中存在手机或计算机的操作系统一样。请记住,它基本上是软件,很明显,某些类型的软件因为允许我们做什么而具有价值。

如果是虚拟的,不能让人重复吗?

是的,但这不是问题。所有区块链交易存储在该公共分类帐,区块链上。您可以复制区块链,但它只是一个记录。所以你不会改变比特币的分配。为了处理比特币中的新交易,具有强大计算机的矿工解决了复杂的问题,这些问题将区块链中的交易添加到区块链中。这被称为“工作证明”,是大多数加密货币的核心特征之一。多名矿工验证工作,防止欺诈。

这是法定货币吗?

还没有在美国正式。 “法定货币”是指一个国家或者一个国家的法律要求任何债权人接受货币支付债务。例如在美国,商人必须接受美元,这使得它成为法定货币。美国政府允许交易比特币,但并不要求每个美甲店,汽车经销商或餐厅都接受。他们必须接受美元。与此同时,日本和澳大利亚等国也正式承认比特币为合法货币。

比特币背后的抵押品是什么?

没有!比特币区块链记录所有比特币的全部交易历史,通过工作证明进行验证。但是,这不是抵押品。没有其他有形的资产支持比特币,汽车作为汽车贷款抵押品的方式或建筑物为商业地产贷款提供抵押物。

谁跟踪每个比特币?

所有维护这个系统的矿工。

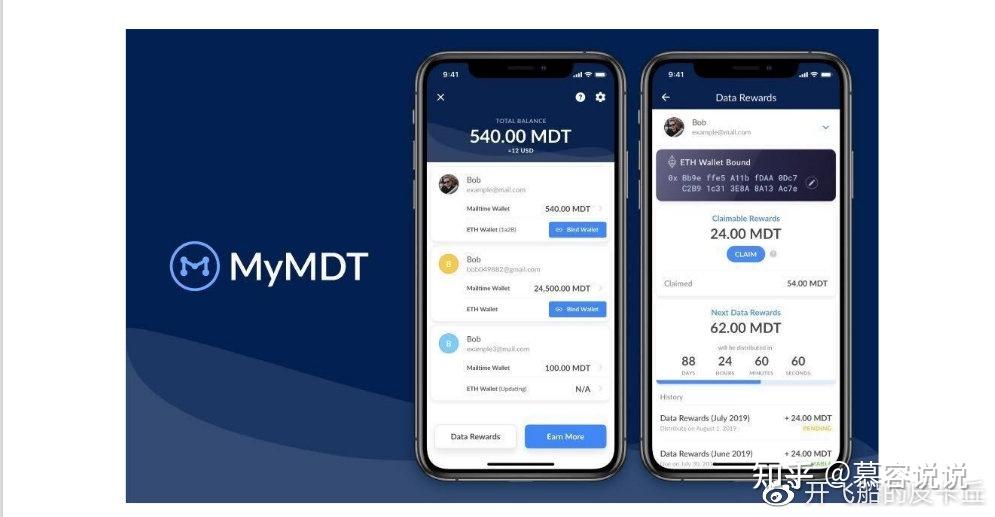

你如何买卖?

有一些易于使用的交易所,您可以使用从银行账户转账的资金购买比特币,在某些情况下还可以通过向信用卡收取费用。

你究竟在买什么?

你正在购买一个数字“钥匙”,这是一串数字和字母,给你一个支持比特币的区块链的独特要求。无论比特币的市场价格是多少,您都可以将此资产转让给他人,减去交易费用。

他们可以在常规经纪账户中购买吗?

Vanguard,Fidelity和Schwab等传统券商尚未提供直接购买比特币的能力。但是有些证券与比特币的价值挂钩,比如BitcoinInvestment Trust,您可以通过传统的经纪商来购买。这不会比比特币更安全。事实上,大多数情况下,它们都是非常不稳定的,就像货币一样,它们不一定完全跟踪比特币的价格。

你需要多少钱才能开始?

不多。例如,Coinbase可以让您购买比特币,以太坊或莱特币等1美元。

比特币可以分数购买吗?

是的。一个比特币可以分成8个小点,或0.00000001比特币。这相当于一枚硬币的百万分之一。该单位被称为satoshi,以纪念比特币的假名创始人。如果一个比特币的价值是1.5万美元,那么一个比特币的价值就是0.015美分。

可以追溯到你吗?

是。任何购买或出售比特币的人如Coinbase必须提供其个人信息,以便交换。如果执法机构或国税局需要了解您的情况,交易所将不得不提供与政府银行或经纪行相同的法律信息。但是,您的个人信息不会成为区块链的一部分,对维护区块链的矿工而言不可见。

如果您在同行交易中与别人私下交易比特币,那么这个人可能对您有所了解,但是没有其他人会看到这个交易。如果你是一个黑社会的洗钱者,那么就有一种叫做“比特币混合”的方法。多个比特币所有者把他们的比特币发送给一个称为混合器的服务器,混合器从多个来源汇集比特币,然后重新分配比特币给他们的原来的业主数量。这是冒险的,并假定混音器不会与你的硬币流失。

当我买一个密码的时候,我的钱在哪里?

当你购买比特币或任何其他加密货币时,有人会把它卖给你 - 所以大部分钱都卖给了卖家。交易所也收取进行交易的费用,这些交易非常高。比特币矿工也为维持网络的角色赚取交易费。那些往往是微小的。

比特币是真钱吗?我可以随时兑现吗?

比特币的价值可以转换成普通货币,或者用来从sellerst接受比特币购买。所以从这个意义上讲,这是真正的金钱,只要有愿意购买它的市场,它就会保持真正的货币。为了“兑现”比特币,您需要将其出售给某人,以换取美元或其他货币。处理此类交易的交易所经历过频繁的交易,这会阻止一些人访问他们的账户或执行交易一段时间,特别是当比特币价格出现大幅波动时。所以不要以为任何时候你都可以卖掉。

除了稀缺之外,还有什么价值呢?

什么买家和卖家认为比特币值得。换句话说,很多心理学。

他们是如何被盗的?

比特币区块链本身是非常安全的,但是如果小偷能够登录到你的账户并且把比特币发送到他们控制的另一个账户,比特币就可以从账户中获得利益。一旦比特币被转移,它就无法被回收。盗贼通常通过窃取登录信息和密码信息进入其他人的账户。这使得使用所有可能的措施来保护比特币账户非常重要,包括使用移动电话的双重身份验证。您还有一个“私钥”,这是您可能需要的第三层安全保护措施,如果您有任何关于谁记入您的帐户的问题。这个键通常是一串键盘字符,应该被存储在不能被丢失或被盗或者通过互联网访问的地方。

比特币如何产生收入?

矿工们赚取比特币的钱 - 创造比特币,这有助于弥补过程所需要的时间和电脑的成本。他们还从比特币用户那里赚取小额交易费用。比特币本身不会产生收入。最好把它看作是一种类似于黄金的商品,它具有市场价格,但并不像经营企业那样产生经济活动。价值上涨时,比特币可以创造利润。但是,价值下降也会造成损失。

在黑色市场交易和赎金之外,这种货币是否有价值?

是。由于比特币转账无法追踪,因此比特币经常被用来购买毒品或被盗神,或者为其他类型的犯罪活动提供资金。但是它也有合法的用途,可以作为支付的形式。一些投资者认为比特币是一个价值储存库,它是一个货架期长,价值普遍上升的资产。虽然这可能是过去几年的趋势,但是,我们无法确定比特币将长期保持其价值。

比特币和其他加密货币有什么区别?

这取决于你想知道哪种货币,现在有数百种。一些硬币,比特币现金,比特币黄金或莱特币,是由主要的比特币代码产生的。然后在自己的区块链上运行,比如ether或XRP。

为什么价格波动很大?

有相当多的资金涌入相对较小的市场,复杂性增加,交易比特币比一般管制市场上的典型证券或商品更难。当市场上的买家和卖家相对较少时,价格往往会出现大幅度的上涨,这样很容易推高价格。

比特币有多大的波动是由于大资金对新兴市场或外部投资者的市场价格的影响?

彭博社报道称,约有40%的比特币拥有大约1000人,许多人认为这些“鲸鱼”会影响比特币的价格。但是没有证据。虽然我们不知道manypeople在任何时候如何交易比特币,但区块链是公开的。区块链确实显示每天都有大量的交易,但是它们通常不足以产生我们所见过的巨大价格。另外请记住,在股票市场上,大型机构通常将订单拆分成更小的订单,以隐藏其规模。比特币的大买家或卖家可以很容易地做到这一点。

这是泡沫吗?

没有人知道。近几个月的价格暴涨肯定是泡沫。许多最近的买家想要拥有比特币不是因为它的内在价值,而仅仅是因为他们认为它会升值。这是猜测,这是经常助长泡沫。但是也有可能比特币是一个真正的创新,将在很长一段时间,并帮助转型的钱。值得回顾的是,互联网的创造导致了20世纪90年代末的互联网泡沫以及随之而来的痛苦的崩溃。但是互联网仍然在这里,一些在二十一世纪初发生碰撞的科技公司现在是世界上最有价值的公司之一。

如果比特币泡沫确实爆发了,那么所有的加密货币还是比特币?

随着时间的推移,加密货币的世界趋于向相同的总体方向移动。但他们并不像以前那样密切相关。例如,在雅虎金融加密货币指上,您会看到每天的价格变动对于我们追踪的100多个硬币是完全不同的。尽管如此,比特币的大举举动通常会产生波及效应:在整个加密经文中,涟漪或XRP是市值的第四大加密货币)。如果比特币的收益率达到90%,那么其他加密算法也很有可能效仿。真正的考验是哪些密码能够在崩溃中幸存下来,亚马逊,eBay和Priceline是如何在网络泡沫崩溃之后幸免于难的。

我听到有人猜测比特币将达到100万美元,或者会崩溃,变得毫无价值。最可能的是什么?

这两个事件都是可能的,也许都是。比特币可能一路攀升至100万美元,然后还会遭遇巨大的崩溃。没有人知道比特币的价格有多高,比特币可能已经达到了历史新高。但是,除非发生了一些灾难性的事情,比如在代码中发现致命的缺陷,否则比特币可能永远不会变得毫无价值。

有什么风险?

有些东西可能会扰乱对比特币的需求,导致价格暴跌。这可能是一个技术问题,监管干预,或由于挖掘比特币所需的大量电力而产生的糟糕宣传。这也可能是完全无法预料的事情。或者,一些新的投机时尚可能会出现,对比特币的兴趣减弱。

我应该使用比特币“硬件钱包”吗?

这是一个好主意。丹·罗伯茨解释了如何做到这一点。

我们如何获得这些公司?

他们不回复电子邮件。对不起,但这是个想法。对于许多比特币的热心支持者来说,一个巨大的好处就是它的权力下放 - 缺乏中央权威和缺乏监管。当然,这些都是政府压力对金融服务公司施加压力,使得客户受到损害的行为。毕竟,中央权威并不是那么糟糕。

这是一个敏锐的答案。实际上,Coinbase和其他提供比特币访问的中介机构可以更好地回应有问题或有问题的客户。请记住,这些公司中的大多数都是初创公司。不断给他们施加压力。他们应该变好。

会不会有通过电话的客户服务?

你是说,像先锋或富达?多么新颖的想法。我们将会看到,但是现在只有当您的帐户存在安全问题时,您才可能听到Coinbase的声音。

政府会不会放弃它?

可能不会。 例如,政府已经在某种程度上与华盛顿介入,允许交易由商品期货交易委员会监管的比特币期货。 比特币成为金融体系中较为成熟的一部分,将受到更多的监管。 但是这不一定是坏事。 一些比特币投资者认为,如果政府更多地管理比特币,那实际上将使货币合法化并扩大其采用。

加密货币是否会接管美元和其他货币?

美元是世界上最值得信赖的货币,很难看到任何东西的摆脱。加密货币可以在整个货币市场中占有一席之地,特别是如果美国政府明确授权某些加密货币并允许人们向他们纳税的话。但即便如此,美元也许不会失效,美元对其所提供的流动性而言无处不在。

雅虎财经的贾斯廷·安德希尔在上一次新闻发布会上问联储主席耶伦是否考虑发行自己的加密货币。耶伦说,包括美联储在内的中央银行的确在调查数字货币,但强调这些与加密货币不同。她表示,比特币是一种不稳定的高投机资产 - 但是她并没有表明有任何即将关注的规定。

加密货币会破坏全球市场吗?

不。根据研究公司Capital Economics最近的分析,即使比特币崩溃,它也不会对更广泛的金融市场产生重大影响。比特币的市值仍然很小,加密货币并没有融入实体经济或银行体系。根据分析,价格全面下滑 - 价格跌至0美元 - 相当于股票回落0.6%。一小部分家庭的开支可能会受到影响,有些人会遭受百万美元的损失。但是很多持有大比特币的人都是在价格非常低的时候买入的早期投资者。所以他们在比特币的高峰估值方面可能看起来是巨大的损失,但他们仍然是相当适度的初始投资。

加密货币可以购买什么类型的产品或服务?

虽然它被称为加密货币,但并不清楚比特币的最佳用途是否会用它来购买东西,因为您可以通过其他方便的方式购买东西。投资者最终可能将比特币视为价值储备,类似于商品。

但是如果你必须的话,你现在可以在Zynga,Overstock.com,Newegg.com,Expedia.com以及一些微软的在线平台上花费比特币。如果您预订旅程,CheapAir.com会将加密货币作为付款。一个名为eGifter的在线装备允许你使用比特币从200多个品牌购买礼品卡。

你也可以买更昂贵的东西,例如维珍银河的理查德·布兰森的商业航天公司。位于曼哈顿的精英幼儿园Flatiron和Soho的蒙台梭利学校接受比特币每年近32,000美元的学费。REEDS Jewelers接受比特币的戒指,手表和其他高级珠宝。

职业运动正在流行起来,NBA的萨克拉门托国王队和圣何塞地震队的足球队接受了比特币的门票和商品。政治党派也是如此,自由派人士通过BitPay接受捐赠。年度最高限额为33,900美元,谁知道呢,有一天它可能会等于一个比特币。

我可以在家得宝使用吗?

不直接。但是,在一些零售商中,大多数是电子商务,这种情况正在逐渐显现:Overstock接受比特币,微软的Xbox商店,PayPal和Square也允许商家接受比特币。

它会被用作正规零售商的货币吗?

这取决于零售商的内容。如果消费者最终发现比现有的方法更便宜或更容易使用比特币,那么这可能是零售商决定提供的东西,以获得竞争优势。他们甚至可能鼓励顾客用比特币支付,如果交易费用少于信用卡费用。但是,直到比特币的价格变得更加稳定之前,广泛采用似乎不大可能。

为什么典型消费者宁愿使用加密货币而不是信用卡?

现在,不是真的,除非你想保持匿名。现金允许,显然。为了更大的目的,比特币确实提供了匿名性和电子交易的安全性。

在加密货币中进行全球经济活动的百分比是多少?

很少。但比特币资助了很大一部分犯罪活动。

你如何跟踪各种加密货币?

有没有可以跟踪的代码?是的。 Yahoo Finance现在为100多个加密货币提供完整的免费跟踪工具,每个代码都有一个代码。大多数人甚至不知道有那么多加密货币。我们也有所有加密货币新闻的登陆页面和我们的原始报道。

就投资而言,加密硬币更像是股票还是货币?

这很复杂,因为比特币和其他加密货币有两个共同的特点。人们经常比较密码到第三类,黄金。这种标签混淆的原因是您有时会听到加密货币被称为“数字资产”或“数字黄金”。

ETF的可用性?

可能。美国政府最近允许交易比特币期货,这可能是建立将在主要交易所上市的交易所交易基金的先驱。证券交易委员会将不得不批准这样一个ETF。这可能是一年之后,更多。

为什么加密货币的交易价值之间存在巨大的差距?

首先,不同的加密货币交换自己的动力。未付硬币的数量,使用方法不同,操作规则不同。比特币是其中最大的一个,它做出了一个巨大的举动,它往往会产生溢出效应,其他加密货币也会一起移动。然而,随着时间的推移,这种效应已经减弱,因为加密货币已经成熟并与众不同。

另一个问题是单一加密货币的交易价值在各种交易中的差异 - 主要是在比特币市场。这是由于套利成本相对较高,或者在低价交易所购买资产并在高价交易所出售,从而获得微利。需要花费时间来完成每一笔或那些交易,交易过程中不保证价格会一样。只要大多数交易所流动性相对较低,交易费用高昂,这些差距就可能持续下去。

你有把比特币报告给国税局吗?

国税局认为比特币是财产的等价物,利润(或损失)的征税差不多与销售股票的收益相同。国税局最近赢得了对Coinbase的法庭裁决,要求交换所报告2013年至2015年年交易额超过20,000美元的客户的信息。国税局似乎不可避免地要把加密货币投注的利润和损失视为同等待遇其他投资收益。

应该把退休储蓄投入加密货币吗?

你能承受失去一切吗?如果做不到,那么就不要使用加密货币了 - 波动性和风险与完全退休计划相反。

如果我不把5%的退休储蓄投入到电子货币中,我会后悔吗?

如果你愿意把一小部分储蓄投资于高风险的工具,那么一定要这样做。但是,不要这样做,除非你能承受所有这些钱。

如何在没有实际购买货币的情况下接触加密货币?

很高兴你问!因为雅虎财经现在已经建立了一些公开交易的公司名单,并加入了一些加密货币。到目前为止,名单上有13个代表,包括像Nvidia和微软这些熟悉的名字。我们将增加更多的保证。

更复杂的投资者可以在LedgerX平台上交易比特币选项,在Cboe期货交易所和CME集团交易比特币期货。在Cboe,一个比特币合约代表一个比特币的价格。在CME,一个比特币合约代表五个比特币的价格。两者都以现金结算,所以你不必忍受或拿走任何实际的比特币。您需要使用LedgerX开设账户来交易比特币选项。为了交易比特币期货,您需要向作为必要交易所成员的经纪人开设经纪账户。许多大型经纪人正在采取观望态度,仍然没有让客户交易比特币期货。其他人需要高利润率,这是客户为交易期货所必须承担的金额。

比特币崩溃将如何影响传统投资?谁说会崩溃?

认真。但根据Capital Economics的报告,如果你想成为一个黑客,好消息是比特币和股票等其他风险资产之间似乎没有任何关联。比如,近几周股市涨势有所放缓,比特币持续走高。如前所述,比特币已经与黄金相比,但它肯定不是一个“安全的避风港”资产。虽然上周黄金价格已经下滑,但加密货币继续攀升。正如Capital Economics所说,比特币是一个“自己的世界”。

为什么Jack Bogle和Jamie Dimon告诉投资者远离比特币?

因为他们认为它没有固有的价值,而且价格只会上涨,因为买家认为未来有人会为比特币付出比现在支付更多的钱。嵌入他们的意见是期望有一天会有一个比特币崩溃,投资者失去大部分,即使不是全部的投资。但这些只是意见。

银行如何看比特币?朋友?敌人?伙伴?

银行不是粉丝。摩根大通对比特币是敌对的。花旗怀疑。高盛很好奇。几乎所有的大型银行都有经纪公司,他们是期货交易所的成员,现在正在交易比特币期货。这些期货合约最终将比特币带到华尔街。但要建立华尔街经纪人的信任还需要时间。在此之前,交易量和流动性将会很低,大多数交易在零售交易商中发生,而不是在机构间交易。

就在比特币期货上线之前,以期货业协会为代表的大型银行和经纪商向美国期货交易所的CFTC发出了一封公开信,警告说,比特币期货在没有透明度或风险评估的情况下被冲上市场。这导致许多大型经纪商暂时避开比特币期货市场,拒绝让客户交易。其他人则为特定客户保留交易权利。

在加密货币市场上有上市公司吗?

没有哪一个在美国是众所周知的,虽然可能在海外,因为世界各地有数百个加密货币交易所和数十个公共股票市场。然而,越来越多的上市公司以“区块链”为名,并声称通过投资区块链技术,采矿业务和特定加密货币来获得这个新的领域。小心这些。许多公司通过对现有上市公司进行反向收购来避免严格的上市流程,而现有上市公司往往从事完全不同的业务。这增加了投资这些公司的任何人的风险。未来可能的一个大公众华尔街经纪人将成为比特币期货的做市商。但还没有发生。

它将如何影响各国征收所得税的能力?

如果比特币成为一个灰色或黑色市场的次级经济体,人们可以隐藏收入,那么政府就会有动力去打击和限制使用新的货币。当然,现在已经有一个大的地下经济,现金和其他类型的资产以隐藏交易的方式交换。而且还有大量的海外税收避难所。美国国税局最近对Coinbase交易所提起的诉讼表明,美国政府正在关注并愿意积极确保纳税人不使用加密货币来骗税。

有没有办法让所有投入的资金因病毒或黑客而消失?

当谈到比特币网络本身,这是一个可能性,但不太可能。运行比特币网络的代码是开源的。目前有超过350人在工作,任何人都可以检查。有了这么多训练有素的代码的眼睛,这是不太可能屈服于病毒或黑客。

比特币的弱点在于个人交易水平,因为交易所已经被黑客攻击了戈克斯,已经被公开为欺诈行为。即使是最大的交易所,在交易量激增的日子也会遇到停电。一个大交易所的中断可能会影响比特币的价格,但是一个交易所可能不会使整个网络崩溃。这从来没有发生过,但如果世界上最大的比特币交易所被全部砍掉或者崩溃,那么比特币可能会是灾难性的。

区块链可以消失吗?

如果区块链的每个副本都以某种方式被删除,那么整个区块链就会消失。但是这不太可能。然而,由于区块链的设计方式,部分区块链在失效时消失是很常见的。对于工作证明(比如比特币)的加密货币,矿工们竞争处理交易,使他们赚取新的硬币以及交易费用。规则要求每个人都遵循最长的区块链。有时,并发区块链并行发展,出于各种技术原因。当一个链变成一个单一的块比另一个长时,较短的一个是无效的,连同其中的所有交易。这对于在较短的区块链中投入时间和计算能力的败诉方来说是不可取的。一般来说,这会激励矿工们去管理区块链并保持其规模。

一旦2100万的限制发生,比特币是否会增加供应?

如果至少有51%的比特币矿工同意改变规则,那么有可能。一个问题是,维护网络的矿工将在最后一个比特币开采后退出,因为他们只能从交易费中赚钱,这可能不够赚钱。买家和卖家也有发言权,因为他们决定是否愿意支付费用。从某种意义上说,比特币市场将会像其他市场一样发展,涉及生产者,消费者,买家,卖家和中间商,他们不断就价格和条款进行谈判。

不急于决定。直到2140年前后123年,矿业者才会生成最后一个比特币。那么,就我们所知,计算能力将呈指数级增长,人类可能会与机器人交配。比起是否取消比特币上限,我们不难想象更大的担忧。

如果我急需这笔钱,那么从加密货币中兑现多少钱呢?

不像你想的那么简单。比特币并不像其他投资那样流动,部分原因是在良好的情况下,和解可能需要一周多的时间。波动性和需求激增导致Coinbase和Kraken等交易所频繁中断,如果您无法访问您的帐户,则无法出售。如果在恐慌性抛售中出现这样的中断,一些比特币持有者可能无法长时间卖出,这可能会使价格下跌的严重损失更大,而想要出售的人不能。这可能会损害对资产的信心。

银行界是否会将比特币纳入他们的商业惯例,还是更有可能共同开发一种新型的加密货币?

银行会做他们感兴趣的事情。现在,没有一个大的流通市场来交易加密货币。新的比特币期货可能会变得足够大,与机构资金进行交易。在那个时候,大银行(也有经纪公司)可能会主宰比特币市场,也许还有其他加密货币。

如果银行业要发展自己的加密货币,那么在智能合约的基础上,它就是有意义的。这将允许他们提供和控制最初的硬币发行,当时可能受到证券交易委员会的监管。这是猜测,至少几年。

我们如何将加密货币加入我们的401(k)计划?

小心,牛仔。管理401(k)计划的金融机构允许访问加密货币可能需要一段时间。首先,没有主流的共同基金或ETF允许这种类型的投资。对于退休账户推出加密产品,零售券商可能会谨慎行事。第一个要求是建立一个比特币ETF,我们估计至少在一年之后。

我可以在不开立期货账户的情况下斩获比特币,也不需要支付很高的费用来寻找GBTC的股票吗?

GBTC是比特币投资信托的一种股票交易产品,是一种在场外交易市场进行交易的交易所信托(这意味着它没有在纽约证交所和纳斯达克交易所上市)。这就是为什么要交易比特币价格的交易者难以借到GBTC的股票。另外,虽然GBTC旨在追踪比特币的移动,但它并不能完美追踪比特币的价格。在比特币交易所交易基金在主要交易所上市之前,如果你想缩短比特币,期货市场会提供更好的选择(虽然流动性在这个早期阶段肯定是很低的)。

另一个加密可以接管比特币吗?

是的,这取决于你如何定义“接管”。比特币网络上的一些问题,比如某些交易所的持续性停电,导致一些比特币矿工今年早些时候将事情交由自己掌握。他们一起联合起来改变比特币代码,以加快网络速度,这种变化被称为“软分叉”。这创造了一种名为比特币现金的单独的加密货币,现在它是按市场价值计算的第三大加密货币。其他新的加密货币每个月都会上市,许多通过同样的软叉过程。这些不一定等于比特币的“接管”,但是它们产生了对比特币主导地位构成威胁的新竞争。

比特币是先行者,然而,固有优势。这是唯一拥有自己期货合约的公司。这可能是首次在一个主要交易所上市的美国ETF,允许普通人轻松投资。但是,如果比特币网络没有赶上比特币疯狂,用户可以从数百个选择,以太炼,涟漪,莱特币和比特币现金作为领先的竞争者。

有多少人在交易比特币?市场什么时候开放?

比特币从不睡觉 - 它每天24小时365次交易。但是,在全球数百个交易所中,在任何时候都没有办法确定有多少人正在交易。我们知道这一点:最初,大多数比特币交易是在西方完成的,但现在大部分是在中国完成的(与人民币交易)。在美国黑暗时常常会发生巨大的价格波动。然而,随着比特币的普及,美元计价账户的数量也在增加。

你如何用美国货币购买其他加密货币,而不是用比特币购买?

交易所决定交易什么样的加密货币以及他们会接受什么形式的付款 - 无论是美元,人民币还是比特币本身。大多数的altcoins不够流行,以激励交易所接受传统货币付款。市场决定如何购买加密货币。

比特币如何“开采”?

通过购买最适合这项工作的昂贵的ASIC设备,或者将采矿应用程序下载到传统的计算机上,这种计算机现在是一种非常慢的生成硬币的方式。这里是你可以学习细节的地方。(ASIC(专用集成电路)是非常强大和昂贵的处理器。)

有人知道比特币是否限制在2100万个单位?

如果它只限于2100万个单位,你怎么知道什么时候开采了2100万个单位,而且没有更多的是我的?比特币网络背后的代码可供任何人检查,区块链分类账也是如此,它记录了比特币交易的全部历史。因此,比特币社区中的每个人都会知道什么时候矿工生产第二百一十万个硬币。那么问题就变成了,接下来呢?

为什么在采矿中使用形卡?

这听起来像货币正在弥补。比特币在2009年被发明时,矿工很快就发现,显卡(GPU)中的处理器比运行计算机的CPU在挖掘比特币方面效率更高。如今,矿工们使用专用于不同加密货币的ASIC。他们的架构仍然与GPU相似。

当所有的比特币被开采时,矿工将如何获得报酬?

他们将通过交易费得到报酬,交易费是由供需决定的 - 最终由发送比特币的人和处理交易的矿工协议。交易费用有一个理论的上限,如果矿工没有得到适当的补偿,比特币网络将变得不安全。这可能发生在最后一个比特币被开采之前,因为比特币的“出生率”随着时间的推移呈指数级地减小 - 这意味着矿工可能无法承担电力成本,因为需要越来越多的资源来开采一枚硬币。但是这种情况可能会在几十年之后消失。

区块链的规模是否永远增长?

只要比特币存在,是的。每笔交易都会累加到累计的比特币分类帐中。

我有一台速度非常快的电脑,我想挖掘比特币和其他货币。我该怎么做?

你可能有一台速度非常快的计算机,但除非处理器是为挖掘比特币而优化的,否则你可能不会以一种能够覆盖电力成本的经济比率来挖掘比特币。称为ASIC的非常强大的处理器每个售价数千美元,并且是为特定加密货币定制设计的。但是如果你在个人电脑上挖掘比特币,那么有几个挖掘应用可供选择。

今天比特币总流通量的百分比是多少?

在开采的2100万比特币中,约有1674万比特币,即大约80%的比特币正在流通中。雅虎财经更新了这个数字和其他比特币的比特币。

比特币在10年内的价格是多少?

当我们学习如何预测未来时,我们会回到你身边。但是,这里有一个可能性:加密货币的技术将会以某种形式存在很长一段时间。

PUOKE 拓展阅读

关于比特币的一切都在这了!(英文原文)

1. What the hell is it?In the most general sense, bitcoin is software that forms adecentralized, peer-to-peer payment system with no central authority like the Federal Reserve or U.S. Treasury. It’s fair to call it a digital currency orcryptocurrency, but at the moment, mostinvestors aren’t really using it as currency to pay for things. Instead, they’reusing it as a speculative investment to buy in the hope of turning a profit.Maybe a big profit. (And maybe a big loss).

2. What backs or supports it?Bitcoin runs on something called blockchain, which is asoftware system often described as an immutable digital “ledger.” It resides on thousands of computers, all over the world, maintained by a mix of ordinary people and more sophisticated computer experts, known collectively as miners.Yahoo Finance’s Jared Blikre dabbles as a bitcoin miner, running mining software in the background on his laptop. Here’s how much bitcoin he hasgenerated so far: 0.000000071589. At the current rate, it would take him about 1,200 years to mine one complete bitcoin. That gives you a sense of how complexit is to mine bitcoin, and how much processing power it takes:

Thesecomputerized miningrigs throw off so much energy that they can heat your home.

All bitcoin transactions are permanently recorded by miners, who upload bundles oftransactions, or “blocks,” to the chain, maintained on all those computers. Blockchainas a technology has become popular among banks and other big financial institutions, who want to use it to settlepayments on their back-end systems. But they’re mostly interested in blockchain without bitcoin.

3. Who’s running the show?Bitcoin is decentralized, which means there isn’t one arbiter, central party or institution in charge. Blocks of transactions arevalidated on the blockchain network through computing “consensus,” which is afeature of the software. Bitcoin was created by someone in 2009 using thepseudonym Satoshi Nakamoto, but it isn’t known who that was, and thatperson or group doesn’t have control over bitcoin today .

4. What is there to value?The price of bitcoin fluctuates based on buying and selling,just like a stock, but there’s a ton of debate over what the price represents.In theory, the value of bitcoin should reflect investors’ faith in bitcoin as a technology. But in reality, investors mostly see bitcoin as a commodity becauseof its finite supply. Under Satoshi’s blueprint, the total supply of bitcoinwill eventually be capped at 21 million coins. At the moment, 16.7 millionbitcoins have been created. A fractional amount of new coins gets created everytime a miner uploads a block to the blockchain, which is a reward for mining.

5. Is this a scam? It’s not a scam, in the sense of somebody marketing a bogus product. Bitcoinis a legitimate technology. The question is how useful and valuable it will become.

6. Is there actually a physical coin called bitcoin?No. You can’t touch a bitcoin becauseit’s essentially software. You may have seen images of gold coins with a “?” onthem. Those are souvenirs that can’t be converted into actual bitcoin. Butthey’re better for illustrating news stories than the streams of numbers andletters that resemble the actual blockchain.

7. Is it tangible like gold? Bitcoin has onebig similarity to gold, in that some investors consider it a good store of value forfinancial wealth. You can take possession of your bitcoins — as some people dowith gold — by downloadingthe string of digital codes that represents your holdings onto a gizmo thatlooks like a flash drive. But you can’t run your fingers through your bitcoin the way youmight with a pile of gold doubloons, and bitcoin certainly isn’t pleasinglyshiny.

8. Is value completely determined by the free market?For the most part, yes. There’s a knownand limited supply of bitcoin, so when demand goes up, so does the price.Technical innovation also contributes to bitcoin’s value. It was a novelty whenfirst created in 2009, and the market has determinedthat it’s aninvention that’s worth something.

9. How can something that does not exist in the material world havea monetary value?Bitcoindoes actually exist in the material world, the same way an operating system foryour phone or computer exists in the material world. Remember, it’s essentiallysoftware, and it’s very clear that certain types of software have value becauseof what they allow us to do.

10. If it’s virtual, can’t people make duplicates? Yes, but that’s not a problem. All bitcointransactions are stored on that public ledger, the blockchain. You can copy theblockchain, but it’s just a record. So you wouldn’t be changing thedistribution of bitcoin. To process new transactions in bitcoin, miners withpowerful computers solve complex problems that add the transactions in a blockto the blockchain. This is called “proof of work” and is one of the corefeatures of most cryptocurrencies. Multiple miners verify the work, whichprevents fraud.

11. Is this a legal tender? Not officially yet in the United States. “Legal tender” means thelaws of a state or nation require any creditor to acceptthe currencytoward payment of a debt. In the United States, for instance,merchants must accept the U.S. dollar, which makes it legal tender. The U.S.government allows transactions in bitcoin, but doesn’t require every nailsalon, car dealership or restaurant to accept it. They do have to acceptdollars. Meanwhile, Japanand Australia, among other countries, have officially recognized bitcoin as legalcurrency.

12. What is the collateral behind bitcoin? Nothing! The bitcoin blockchain records theentire transaction history of all bitcoin, which is validated through proof ofwork. That’s not collateral, however. There’s no other tangible asset backingbitcoin, the way a car serves as collateral for a car loan or a building servesas collateral for a commercial property loan.

13. Who keeps track of each bitcoin?All of the miners who maintain thesystem.

14. How do you buy and sell it? There are a number of easy-to-use exchangesnow where you can buy bitcoin using money transferred from a bank account, andin some cases by charging a credit card. The most popular mainstream option isCoinbase, which now has more than 13 million customers. Kraken is another one.Here’s our full explainer on how tobuy bitcoin .

15. What are you actually buying? You’re buying a digital “key,” which is astring of numbers and letters that gives you a unique claim on the blockchainsupporting bitcoin.You can transfer this asset to others for whatever the marketprice of bitcoin is, minus transaction fees.

16. Can they be purchased in a regular brokerage account?Traditional brokerages such as Vanguard,Fidelity and Schwab don’t yet offer the ability to purchase bitcoin directly.But there are securities linked to the value of bitcoin, such BitcoinInvestment Trust, whichyou can buy through a traditional brokerage. That doesn’t make them a saferinvestment than bitcoin. Most, in fact, are highly volatile, just like thecoin, and they don’t necessarily track the price of bitcoin perfectly.

17. How much money do you need to get started?Not much. Coinbase lets you purchase as little as$1 of bitcoin, ethereum or litecoin, for instance.

18. Can bitcoin be purchased in fractions? Yep. One bitcoin is divisible down to 8decimal points, or 0.00000001 bitcoin. That’s the equivalent of oneone-hundred-millionth of a coin. That unit is known as a satoshi, in honor ofthe pseudonymous founder of bitcoin. If one bitcoin is worth $15,000, the valueof a satoshi would be .015 cents.

19. Can it be traced back to you? Yes. Anyone who buys or sells bitcoin on anexchange such as Coinbase must provide their personal information to thatexchange. If law-enforcement agencies or the IRS need to know something aboutyou, the exchange will have to provide the info under the same laws that governbanks or brokerages. But your personal info does not become part of theblockchain and is not visible to miners maintaining the blockchain.

If you trade bitcoin privately with someone else in a peer-to-peer transaction,that person may know something about you, but nobody else would see thetransaction. And if you’re a shady character aiming to launder bitcoin, there’sa way, called “bitcoin mixing.” Multiple bitcoin owners send their bitcoins toa service known as a mixer, which pools bitcoin from multiple sources, mixesthem up, and redistributes them to the original owners in the amount theycontributed.This is risky and assumes the mixerdoesn’t run off with your coin.

20. Where is my money going when I buy a crypto?When you buy bitcoin or any othercryptocurrency, somebody is selling it to you — so most of the money goes tothe seller. Exchanges also charge fees for conducting transactions, which canget very high . Bitcoin miners also earn transaction fees for their role inmaintaining the network. Those tend to be tiny.

21. Are bitcoins real money? And can I cash them in whenever I want? Bitcoin has value thatcan be converted into ordinary currency, or used to make purchases from sellersthat accept bitcoin. So in that sense, it’s real money, and it will remain realmoney as long as there’s a market with people willing to buy it. To “cash in”bitcoin, you need to sell it to somebody, in exchange for dollars or some othercurrency. Exchanges that handle such transactions have experienced frequentoutages that prevent some people from accessing their accounts or executing atrade for a period of time, especially when are there large movements in theprice of bitcoin. So don’t assume you’ll be able to sell any time youwant.

22. What is the value based on, besides scarcity?What buyers and sellers think bitcoin isworth. In other words, a lot of psychology.

23. How are they stolen? The bitcoin blockchain itself is very secure, but bitcoins can bestolen from an account if thieves are able to log intoyour account and send the bitcoin to another account they control. Once bitcoin is transferred, it can’t berecovered. Thieves typically break into other people’s accounts by stealinglogon and password info. That makes it extremely important to use all possiblemeasures to safeguard a bitcoin account, including two-factor authenticationwith a mobile phone. You also have a “private key,” which is a third layer ofsecurity that you might need at some point, if there are questions about who’slogging into your account. This key is typically a string of keyboardcharacters that shouldbe stored where it can’t be lost or stolen or accessed through the internet.

24. How does bitcoin generate revenue?Miners earn money–paid in bitcoin–forcreating bitcoin, which helps cover the cost of time and computer power thatthe process requires. They also earn small transaction fees from bitcoin users.Bitcoin itself doesn’t generate revenue. It’s best thought of as a commodity,similar to gold, that has a market price but doesn’t generate economicactivity, the way a business does. When the value goes up, bitcoin can createprofits. But when the value goes down, it can also create losses.

25. Is there value in this currency outside of black markettransactions and ransoms? Yes. Since bitcoin transfers can’t be traced, bitcoin is often usedto purchase drugs or stolen gods or finance other types of criminal activity.But it also has legitimate uses, and can be used as a form of payment withanybody who accepts it. Some investors consider bitcoin to be a store ofvalue–an asset that has a long shelf life and whose value generally goes upover time. While that may be the trend of the last several years, however, westill can’t be sure bitcoin will hold its value long-term.

26. What’s the difference between bitcoin and othercryptocurrencies?That depends which currency you want to know about, and there are hundreds of themnow. Some coins, like bitcoin cash, bitcoin goldor litecoin, resulted from forks of the main bitcoin code. Then there are coinsthat run on their own blockchain, like ether or XRP .

27. Why does the price fluctuate so much?There’s a lot of money pouring into arelatively small market, with the added complexity that it’s harder to tradebitcoin than typical securities or commodities on a regulated market. Big priceswings happen sometimes when there are relatively few buyers and sellers in themarket, which makes it easy to push the price around.

28. How much of the volatility of bitcoin is due to whalesinfluencing the market price versus new or outside investors?Bloomberg reports that about 40% ofall bitcoin is owned by roughly1,000 people

, and many people believe these “whales” collude to influence theprice of bitcoin. But there’s no proof of this. While we don’t know how manypeople are trading bitcoin at any given time, the blockchain, which is thetransaction log, is public. The blockchain does show large trades taking placeevery day, but they’re typically not big enough to generate the huge priceswings we’ve seen. Also keep in mind that in the stock market, largeinstitutions typically break up their orders into much smaller orders, to hidetheir size. Big buyers or sellers of bitcoin could easily do the same.

29. Is it a bubble? Nobodyknows for sure. The price surge in recent months has certainly beenbubblicious. Many recent buyers want to own bitcoin not for its inherent value,but simply because they think it will rise in value. That’s speculation, whichis what often fuels a bubble. But it’s also possible bitcoin is a genuineinnovation that will be around for a long time and help transform money. It’sworth recalling that the creation of the Internet led to the dot-com boom inthe late 1990s, and the painful crash that followed. But the Internet is stillhere, and some tech companies that crashed in the early 2000s are now among themost valuable companies in the world.

30. If the bitcoin bubble does burst, would all of thecryptocurrencies tank or just bitcoin? The universe of cryptocurrencies tends to move in the samegeneral direction over time. But they’re not all as closely correlated as theyused to be. On the YahooFinance cryptocurrency index, for instance, you’ll see the daily price movements are quitedifferent for the 100+ coins we track. Still, an outsized move in bitcointypically has ripple effects throughout the crypto-verse. Ifbitcoin were to tank by 90%, it seems quite likely other cryptos would followsuit. The real test would be which cryptos are able to survive a crash, the wayAmazon, eBay and Priceline survived the dot-com bust that wiped out hundreds ofother companies.

31. I hear wild speculations that bitcoin will reach $1 million orthat it will crash and be worthless. What is most likely?Either event is possible, and perhapsboth are. Bitcoin could climb all the way to $1 million and then still suffer ahuge crash. No one knows how high the price of bitcoin will go, and it’spossible bitcoin has already achieved its all-time high. But bitcoin probablywon’t ever become literally worthless, unless something catastrophic happens,such as the discovery of a fatal flaw in its code.

32. What are the risks? Something could disrupt the demand for bitcoin, sending the priceplummeting. It could be a technical problem, regulatory interference, or badpublicity arising from the massive amount of electrical power needed to minefor bitcoin. It could also be something totally unforeseen. Or, some newspeculative fad could come along, with interest in bitcoin diminishing.

33. Should I use a bitcoin “hardware wallet”?That’s an excellent idea. DanRoberts explains how to do it.

34. How do we get hold of these companies?They don’t answer emails. Sorry, butthat’s kinda the idea. To many of bitcoin’s ardent supporters, one huge benefitis its decentralization—the lack of a central authority and the absence ofregulation. Those are the very things, of course, that bring governmentpressure to bear on financial services companies that underserve or mistreat theircustomers. Maybe central authority isn’t that bad, after all.

That’sthe snarky answer. In reality, it’s in the interest of Coinbase and otherintermediaries providing access to bitcoin to do a better job responding tocustomers who have problems or questions. Keep in mind, most of these companiesare startups still getting their footing. Keep pressuring them. They ought toget better.

35. Will there ever be customer service via phone?You mean, like Vanguard or Fidelity?What a novel idea. We’ll see, but for now you’re only likely to hear fromCoinbase if there’s a security issue with your account.

36. Will the government keep their nose out of it?Probably not. Governments have alreadystepped in, to some extent, with Washington, for instance, allowing the tradingof bitcoin futures, which is regulated by the Commodity Futures TradingCommission. For bitcoin to become a more established part of the financialsystem, it will be subject to more regulation. But that’s not necessarily bad.Some bitcoin investors think that if governments regulate bitcoin more, thatwill actually legitimize the currency and broaden its adoption.

37. Are cryptocurrencies going to takeover the U.S. dollar and other currencies? It’s hard to seeanything dislodging the U.S. dollar, which is the world’s most trustedcurrency. Cryptocurrencies could gain share in the overall currency market,especially if the U.S. government explicitly authorizes certaincryptocurrencies and allows people to pay taxes with them. But even thatprobably wouldn’t doom the dollar, which is valued everywhere for the liquidityit provides.

YahooFinance’s Justine Underhill asked Federal Reserve Chair Janet Yellen at herlast press conference if the Fed was considering issuing its owncryptocurrency. Yellen said central banks, including the Federal Reserve, areindeed investigating digital currencies but stressed that these are differentthan cryptocurrencies. She said bitcoin is an unstable, highlyspeculative asset— but she didn’t indicate any imminent interest in regulatingit or reeling it in.

38. Will cryptocurrency destroy the global market? Nah. Even if bitcoin crashed, it wouldn’thave a significant impact on the broader financial markets, according to arecent analysis by research firm Capital Economics. For all the attention it gets,bitcoin’s market cap is still small, and the cryptocurrency isn’t woven intothe real economy or the banking system. A total wipeout — with the pricefalling to $0 — would be the equivalent of a 0.6% pullback in stocks, accordingto the analysis. Spending by a small portion of households might be affected,and some people would suffer million-dollar losses. But many people with largebitcoin holdings were early investors who bought when the price was very low.So they might seem like large losses in terms of bitcoin’s peak valuation, butthey’d still represent fairly modest initial investments.

39. What types of products or services can be bought withcryptocurrencies? Thoughit’s called a cryptocurrency, it’s not clear the best use of bitcoin will everbe buying stuff with it, since you can purchase things in so many otherconvenient ways. Investors may eventually regard bitcoin principally as a storeof value, similar to commodities.

Butif you must, you can spend bitcoin right now on Zynga, Overstock.com,Newegg.com, Expedia.com, and some of Microsoft’s online platforms. If you’rebooking a trip, CheapAir.com takes thecryptocurrency as payment. An online outfit called eGifter allows you to buy gift cardsfrommore than 200 brands using bitcoin.

Youcan buy more expensive things, too, such as a reservation for VirginGalactic, Richard Branson’s commercial spaceflight company. The MontessoriSchools in Flatiron and Soho, an elite pre-school in Manhattan, acceptsbitcoin for its nearly $32,000 per year tuition. REEDS Jewelersaccepts bitcoin for its rings, watches,and other fine jewelry.

Prosports is getting in on the craze, with the NBA’s Sacramento Kingsand the San Jose Earthquakes soccer team acceptingbitcoin for tickets and merchandise. So are political parties, withLibertarians accepting donations throughBitPay. The annual maximum is $33,900, which, who knows, might be theequivalent of one bitcoin someday.

40. Can I spend it at Home Depot? Not directly. But it’s slowly catching onamong some retailers, mostly e-commerce: Overstock accepts bitcoin, as doesMicrosoft’s Xbox store, and PayPal and Square allow merchants to acceptbitcoin.

41. Will it ever be used as currency at regular retailers? It depends on what’s in it for the retailer.If consumers eventually find bitcoin cheaper or easier to use than currentmethods, then it might be something retailers decide to offer, to gain acompetitive edge. They might even encourage customers to pay in bitcoin if itcosts them less in transaction fees than credit cards do. But widespreadadoption seems unlikely until the price of bitcoin becomes more stable.

42. Is there any reason why a typical consumer would prefer to usea cryptocurrency instead of a credit card? For now, not really, unless you’re trying to remainanonymous. Cash allows that, obviously. For larger purposes, bitcoin does offerboth anonymity and the security of an electronic transaction.

43. What percentage of global economic activity is conducted incryptocurrency? Verylittle. But bitcoin finances a significant portion of criminal activity.

44. How do you track various cryptocurrencies?Is there a ticker I can follow? Yep.Yahoo Finance now offers full,free tracking tools for more than 100 cryptocurrencies , with a ticker symbol for each. Most peoplearen’t even aware there are that many cryptocurrencies. We also havea landing page for allcryptocurrency news and our original coverage of it.

45. Are crypto coins more like stocks or currency, as far asinvestments?It’scomplicated, because bitcoin and other cryptocurrencies have features incommon with both. People often compare cryptos to a third category, gold. Thislabeling confusion is why you’ll sometimes hear cryptocurrencies referred to as“digital assets” or “digital gold.”

46. ETF availability? Coming, probably. The U.S. government recentlyallowed the trading of bitcoin futures, which may well be a precursor to the establishment ofexchange-traded funds that would be listed on a major exchange. The Securitiesand Exchange Commission would have to approve such an ETF. That could be a yearaway, more.

47. Why are there vast disparities among trading values incryptocurrencies?First,different cryptocurrencies trade on their own dynamics. There are differencesin the number of coins outstanding, different uses for them, and differentrules of operation. When bitcoin, the biggest of them all, makes a large move,it tends to have a spillover effect, with other cryptocurrencies moving intandem. This effect has diminished over time, however, as cryptocurrenciesmature and differentiate.

Anotherissue is the disparity in trading values of a single cryptocurrency across themyriad exchanges — mainly in the markets for bitcoin. This is due to therelatively high cost of arbitrage, or buying the asset on the lower-pricedexchange and selling it on the higher-priced exchange, to make a small profit.The catch is it can take time to make each or those transactions, with no guaranteeprices will be the same when the trade goes through. These disparities willlikely continue as long as there is relatively low liquidity on most exchanges,as well as high transaction fees.

48. Do you have to report bitcoins to the IRS? The IRS considers bitcoin to be the equivalentof property, with profits (or losses) taxed more or less the same as theproceeds from a sale of stock. The IRS recently won a court ruling againstCoinbase that requires the exchange to report information on customers who hadmore than $20,000 in annual transactions from 2013 to 2015. It seems inevitablethat the IRS will treat profits and losses from cryptocurrency bets the same asit treats other investment income.

49. Should one put retirement savings into cryptocurrencies? Can you afford to lose it all? If you can’t,then stay out of cryptocurrencies—the volatility and risk of a wipeout isexactly the opposite of what ought to be in a strong retirement plan.

50. Will I be sorry if I don’t put 5% of my retirement savings intocryptocurrency? If you’recomfortable investing a small portion of your savings in high-risk instruments,then sure, do it. But again, don’t do this unless you can afford to lose allthat money .

51. How can I get exposure to cryptocurrencies without actuallypurchasing the currency? Glad you asked! Because Yahoo Finance has now established a listof publicly traded companies with some exposure to cryptocurrencies. There are 13 tickers on the list so far,including familiar names such a Nvidia and Microsoft. We’ll add more aswarranted.

Moresophisticated investors can trade bitcoin options on the LedgerX platform andbitcoin futures at both the Cboe Futures Exchange and CME Group. At the Cboe,one bitcoin contract represents the price of one bitcoin. At the CME, onebitcoin contract represents the price of five bitcoins. Both settle in cash, soyou don’t have to put up or take delivery of any actual bitcoin. You need toopen an account with LedgerX to trade bitcoin options. To trade bitcoinfutures, you need to open a brokerage account with a broker that’s a member ofthe requisite exchange. Many large brokers are taking a wait-and-see approach,and still not yet letting clients trade bitcoin futures. Others are requiringhigh margin, which is the amount of money a customer must put up to trade thefutures.

52. How will the bitcoin collapse affect traditionalinvestments? Who saidit’s going to collapse? Seriously. But if you want to be a hater, the good newsis there doesn’t appear to be any correlation between bitcoin and other riskyassets such as stocks, according to that CapitalEconomics report. While the stock market rally has slowed in recent weeks, forinstance, bitcoin has continued to surge higher. As mentioned earlier, bitcoinhas been compared with gold, but it’s certainly not a “safe haven” asset. Whilegold prices have dipped in the last week, the cryptocurrency has continued toclimb higher. As Capital Economics put it, bitcoin is a “world of its own.”

53. Why do Jack Bogle and Jamie Dimon tell investors to stay awayfrom bitcoin? Becausethey think it has no inherent value and that it’s only going up in pricebecause buyers think somebody in the future will pay even more for bitcoin thanthey paid for it in the present. Embedded in their opinions is the expectationthat one day there will be a bitcoin crash where investors lose most, if notall, of their investment. But those are only opinions.

54. How do banks view bitcoin? Friend? Foe? Partner? Banks are not fans (yet). JPMorgan is hostiletoward bitcoin. Citigroup is suspicious. Goldman Sachs is curious. Nearly alllarge banks have brokerage arms that are members of the futures exchanges wherebitcoin futures are now being traded. These futures contracts finally bringbitcoin to Wall Street. But it’s going to take time to build the trust of WallStreet brokers. Until then, volume and liquidity will be low, with most tradinghappening among retail traders rather than institutional ones.

Right before bitcoin futures went live, big banks and brokers, represented by theFutures Industry Association, sent an open letter to the CFTC, which regulatesU.S. futures trading, warning that bitcoin futures were being rushed to marketwithout transparency or proper risk assessment. That has led many large brokersto avoid the bitcoin futures markets for now, refusing to let clients tradeyet. Others are reserving trading rights for select clients.

55. Are there any publicly traded companies that make markets incryptocurrencies? Nonethat are well-known in the United States, although there could be overseas,given that there are hundreds of cryptocurrency exchanges and dozens of publicstock markets around the world. There are however, a growing number of publiccompanies that have “blockchain” in their name, and claim to gain exposure tothis new universe by investing in blockchain technology, mining operations, andspecific cryptocurrencies. Beware of these. Many have avoided the rigorous IPOprocess by performing a reverse merger into an existing public company, whichis often engaged in an entirely different business. This adds a level of riskto anyone investing in these companies. It’s possible that in the future, oneof the large public Wall Street brokers will become a market maker in bitcoinfutures. But it hasn’t happened yet.

56. How will it impact countries’ ability to collect incometax? If bitcoinwere to become a substantial gray- or black-market sub-economy where peoplecould hide income, governments would have an incentive to crack down and limitthe use of new currencies. Of course, there’s already a large undergroundeconomy, where cash and other types of assets are exchanged in ways meant tohide transactions. And there are plenty of offshore tax shelters, as well. TheIRS’s recent lawsuit against the Coinbase exchange indicates the U.S.government is paying attention and is willing to be aggressive making suretaxpayers don’t use cryptocurrencies to cheat on their taxes.

57. Is there a way for all the money invested to just vanishbecause of a virus or hack? When it comes to the bitcoin network itself, that’s a possibility,but an unlikely one. The code that runs the bitcoin network is open source.Over 350 people currently work on it, and anyone can inspect it. With so manywell-trained eyes on the code, it’s unlikely to succumb to a virus or hack.

Bitcoin’sweakness is at the individual exchange level, since exchanges have been hackedand others, such as Mt. Gox, have beenexposed as outright frauds. Even the largest exchanges experience outages ondays when volume surges. A disruption at a large exchange can influence theprice of bitcoin, but one exchange probably can’t crash the entire network.It’s never happened, but if the world’s largest bitcoin exchanges were allhacked or crashed at once, it could prove catastrophic for bitcoin.

58. Can blockchain disappear? If every copy of the blockchain were somehowerased, then the entire blockchain would disappear. But that’s unlikely. It iscommon, however, for parts of the blockchain to disappear as they becomeinvalidated, because of the way the blockchain is designed. For “proof of work”cryptocurrencies such as bitcoin, miners compete to process transactions thatallow them to earn new coin, along with transaction fees. The rulesrequire everyone to follow the longest blockchain. Sometimes, concurrentblockchains evolve in parallel, for various technical reasons. When one chainbecomes a single block longer than the other, the shorter one is invalidated,along with all the transactions in it. This is undesirable for the losingparties that have invested time and computing power in the shorter blockchain.In general, this creates an incentive for miners to mind the blockchain andkeep its size under control.

59. Is bitcoin likely to increase its supply once the 21 millionlimit happens?It’spossible, if at least 51% of the bitcoin miners agree to change the rules. Oneconcern is that miners who maintain the network will drop out after the lastbitcoin is mined, because they’d only earn money from transaction fees, whichmight not be lucrative enough. Buyers and sellers have a say, too, since it’sup to them to decide if they’re willing to pay the fees. In a way, the bitcoinmarket will evolve like any other market involving producers, consumers,buyers, sellers and middlemen who continually negotiate over price and terms.

There’sno hurry to decide. Miners aren’t expected to generate the last bitcoin untilaround 2140, 123 years from now. By then, computing power will be exponentiallyhigher and humans may mate with robots, for all we know. It’s not hard toimagine bigger concerns than whether to lift the bitcoin cap.

60. How easy is it to cash out of cryptocurrencies if I need themoney in a hurry?Notas easy as you’d like. Bitcoin is not as liquid as other investments, in partbecause settlement can take more than a week, under good circumstances.Volatility and surging demand has caused frequent outages on exchanges such asCoinbase and Kraken, and you can’t sell if you can’t access your account. Ifsuch outages occur amid panic selling, some bitcoin holders might be unable tosell for a fairly long time, which could make steep losses worse as the pricedrops and people who want to sell, can’t. That’s one thing that could harmconfidence in the asset.

61. Will the banking industry adopt bitcoin into their businesspractices or is it more likely that they will work together to develop a new typeof cryptocurrency?Bankswill do what’s in their interest. Right now, there’s not a big, liquid marketto trade cryptocurrencies. The new bitcoin futures may become big enough totrade with institutional money. At that point, it’s likely the big banks will come to dominate the market for bitcoin, andperhaps other cryptocurrencies.

Ifthe banking industry were to develop its own cryptocurrency, it would makesense for it to be ethereum-like, based on smart contracts. This would allowthem to offer and control the process for initial coin offerings (ICOs), whichwould likely be regulated by the Securities and Exchange Commission at thattime. This is speculation and at least several years off.

(由于篇幅原因,部分问题隐去)

▼

评论